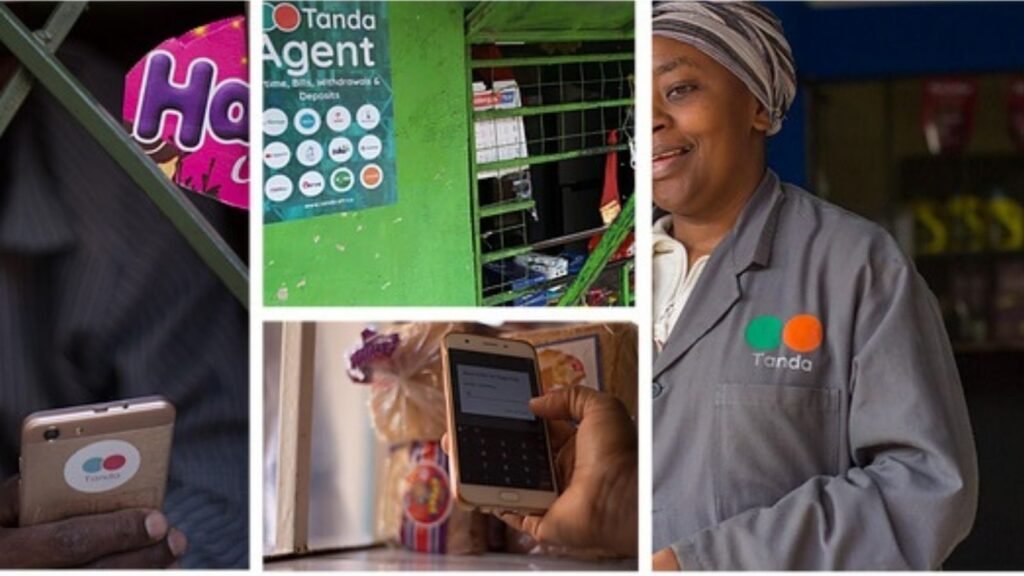

Tanda, an agency banking startup in Kenya, will be expanding its operations across East Africa following it receiving VC funding from HAVAÍC, Zedcrest Capital, DFS Lab, Victor Asemota, and three other investors. This bodes well for the fintech startup as it has also secured key partnerships with Mastercard and Interswitch.

Tanda’s expansion comes on the back of it pioneering and proving the viability of the interoperable agent and merchant model in Kenya. Before this, the agent banking model had only been validated in West Africa.

“Our team will continue to run the aggressive agent and customer acquisition drives across the region while securing more strategic partnerships in these new markets to further support Tanda’s growth and strategy as we pursue our goal of digitizing payments across Africa. Tanda is excited to be at the forefront of the rapid shift towards innovative digital-first solutions, especially in markets that are ripe for disruption,” said Geoffrey Mulei, CEO of Tanda.

The main idea behind the agent banking model is that a financial services institution will utilize a network of local merchants and shopkeepers in areas where they don’t have a presence. In turn, these merchants and shopkeepers provide basic financial and banking services.

Tanda reports that their platform and network currently supports 58 banks and SACCOs (Savings and Credit Cooperatives Societies) in Kenya, four telecommunications companies, 18 billers, 12,000 merchants and agents. Added to this, Tanda has served 300,000 plus unique customers, all of which have processed millions of transactions to date.

“Tanda is solving one part of the very deep and complex problem of financial inclusion that is not only Kenyan but a problem across all emerging and undeveloped markets. HAVAÍC believes that the wider Tanda team has the right mix of skills, technical expertise, geographic market knowledge, and real-world experience to understand the challenges facing those left behind in the financial ecosystem,” said Rob Heath, Partner at HAVAÍC.

Insights and analysis into how business and technology impact Africa. We promise to leave you smarter and asking the right questions every time after you read it. Sent out every Monday to Friday.

This content was originally published here.